An Add-On Application/ Module Built for NetSuite

Get dunning automation in NetSuite for only $149 per month for Basic Dunning and $199 for Advanced Dunning. These rates apply per NetSuite instance/account and are billed annually in advance, with a one-time implementation fee based on a detailed scoping.

This pricing is applicable regardless of the number of included company subsidiaries.

Note: NetSuite OneWorld is counted as one instance/account.

What is Dunning in NetSuite?

Dunning is the process of reminding customers to pay overdue invoices and maintain account balances within a certain range (aka “collections”). It’s an automated system that sends out reminder emails and letters to customers who are past due on their payments.

In NetSuite, the Dunning Letters SuiteApp or the NetSuite Dunning module is the standard offering for automation in the dunning process for NetSuite users. It offers dunning over Customer Level, Invoice Level, or Invoice Group Level. However, NetSuite Dunning Letters can be a challenge for companies due to its lack of customization and functional limitations. Companies need a comprehensive dunning solution to overcome these challenges and allow them to streamline their collections.

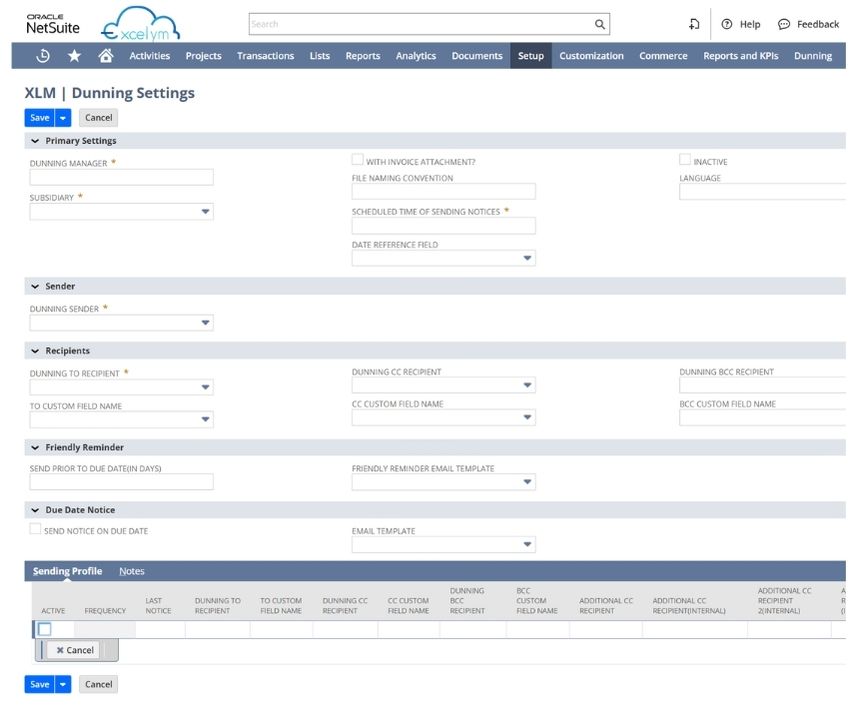

Excelym NetSuite Dunning Solution: Basic & Advanced

We understand that off-the-shelf dunning solutions often fall short of addressing the unique requirements of various companies, particularly in critical business scenarios and complex customer experience situations. To tackle these challenges, we have developed a tailored NetSuite dunning solution.

Our solution effectively solves the common limitations of NetSuite’s Dunning Letters SuiteApp. We offer businesses a flexible, robust, and efficient tool for managing their collections process. Additionally, we strive to make our solution accessible to a wide range of businesses by providing two scalable options: Basic and Advanced Dunning.

-

A. NetSuite Dunning Basic

(Only $149 per month per NetSuite instance/account, billed annually)

- Recipients – Ability to send to multiple recipients, using different fields. This comes with the option to exclude certain customers from the dunning automation.

- Friendly Reminder – Ability to send prior to the Due Date in bulk or automatically.

- Due Date – Ability to send invoices that are due today in bulk or automatically.

- Frequency Level – Ability to send notices to open invoices every n days based on transaction or due date.

- Last Level Dunning – Ability to send looping notices after the last defined frequency level.

- Attachment – Ability to attach a pdf file.

- Subsidiary – Ability to set dunning per subsidiary or multiple subsidiaries.

- Past Due Customer Record – Ability to send Dunning to the Parent Company for all its sub-customers’ overdue invoices.

- Consolidated Notifications for Last Level Dunning – Ability to consolidate all overdue invoices in one notification if there are multiple open invoices of the same frequency level. A prerequisite is that all overdue invoices should have the same aging or same template/messaging.

- Reporting & Forecasting – The reporting and forecasting feature will be launched soon.

-

B. NetSuite Dunning Advanced

(Only $199 per month per NetSuite instance/account, billed annually)

- All the NetSuite Dunning Basic Features

- Multiple Attachment – Supports multiple attachments

- File Merging and Compression – Enables merging and compression of files to comply with NetSuite’s governance and technical limitations on attachment size, allowing attachments exceeding 10MB in total

Advantages of an Automated Dunning Process

Book a demo

Ready to book a demo? Contact us now and get ready for faster payments!

We serve clients globally from these locations:

San Francisco, CA

Jacksonville, FL

Basingstoke, UK

Cebu, Philippines