Last Modified: January 8th, 2024

3 min read

NetSuite’s AP automation takes efficiency to the next level. It reduces the need for manual data entry, automating the process from invoice capture to payment. This allows businesses to streamline their workflows, reduce human error, and increase productivity. Invoices can be automatically matched with purchase orders and packing slips, thereby ensuring accuracy and eliminating the potential for duplicate payments. It also allows for faster approval processes, as key decision-makers can approve payments from anywhere, anytime.

Features of NetSuite’s AP Automation system

Invoice Receipt

NetSuite’s AP automation offers an efficient invoice receipt system. It aids in the transformation of both paper and electronic invoices into a standardized format. This process is accomplished using Optical Character Recognition (OCR) technology, which extracts critical data from invoices. Upon receipt, invoices are automatically linked to the corresponding vendor and purchase order in the system, kick-starting the approval workflow.

Coding and Approval

Invoices often require coding to assign them to the correct expense account. NetSuite’s AP automation system allows for easy coding through its built-in rules engine, which ensures consistency and accuracy in coding. Once coded, invoices are automatically routed for approval based on predetermined workflows and hierarchy. Approvers can view the invoice details, supporting documents, and audit trail before approving or rejecting the invoice.

Approval Routing and Audit Trail

NetSuite’s AP automation system offers a robust approval routing system, providing businesses with the flexibility to customize workflows based on their needs. Approvers can approve invoices from anywhere, anytime, using any device, increasing process efficiency and eliminating bottlenecks. The system also maintains a comprehensive audit trail of all invoice-related activities, ensuring compliance with regulatory requirements.

Automated Payments

NetSuite’s AP automation system enables businesses to streamline their payment processes by automating payments from approved invoices. It allows for different payment methods, such as ACH transfers and virtual credit cards, providing flexibility and convenience based on vendor preferences and payment terms. The system also generates electronic remittance advice, eliminating the need for manual reconciliation.

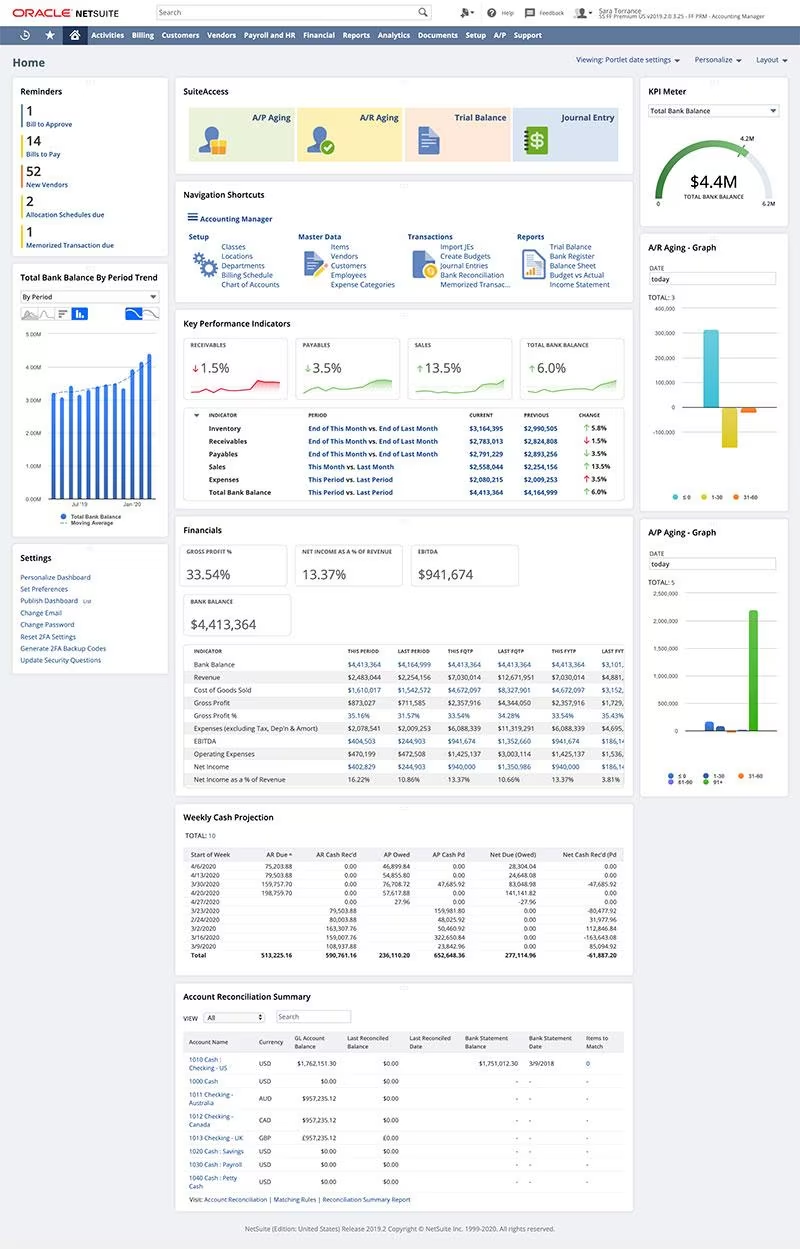

Analytics and Reporting

NetSuite’s AP automation system provides real-time visibility into accounts payable data, which can be used to make informed business decisions. It generates reports on payables aging, cash flow projections, and vendor spend analysis, among others. These insights enable businesses to identify areas for cost savings, improve cash flow management, and negotiate better terms with vendors.

Reconciliation and Integration

NetSuite’s AP automation system integrates seamlessly with other modules, such as General Ledger and Accounts Receivable, providing a comprehensive view of the entire financial picture. It also automatically reconciles payments made against outstanding invoices, ensuring accuracy and reducing the risk of errors.

Take Advantage of Embedded Banking Services

Additionally, leverage the embedded banking services offered by HSBC Bank USA N.A., a member of FDIC (HSBC), to effortlessly settle bills directly within NetSuite. Through HSBC, you get access to a range of payment solutions, including domestic and global payments. With NetSuite’s AP automation system and HSBC’s banking services, businesses can manage their payables seamlessly from one platform.

Automate These Other Accounts Payable Tasks

The accounts payable (AP) tasks that stand to gain the most from automation are those that offer opportunities to reduce processing time and enhance accuracy. These improvements, in turn, lead to cost savings. AP automation holds immense potential to enhance the following steps:

Vendor Management

Reduce time spent on managing vendor information, such as contact details and payment terms. Provide visibility into vendor performance, enabling businesses to identify and address any issues promptly.

Expense Reporting and Reimbursement

Automate employee expense reports for faster processing and eliminate manual data entry. Capture receipts, categorize expenses, and streamline approval for accurate and timely reimbursements.

Fraud detection

Enhance security implementing dual controls and approval thresholds to prevent fraud. The system maintains an audit trail, facilitating the detection and investigation of suspicious activities. Advanced algorithms monitor transactions and flag potential AP fraud, adding an extra layer of security.

Reconciliation

Automate reconciliation of vendor statements with NetSuite’s AP automation system, eliminating manual effort. This reduces errors, provides real-time visibility into outstanding balances, and ensures accurate books. Automation tools also reconcile bank statements, identifying discrepancies for accuracy.

Tax compliance and reporting

Simplify invoicing by automatically applying the correct sales tax and generating tax filing reports. They also reduce the risk of non-compliance penalties by accurately calculating tax liabilities and providing proper documentation.

Why Automate Accounts Payable?

Transform the traditionally labor-intensive and error-prone AP tasks into streamlined processes, providing real-time insights, reducing costs, and mitigating risks. With integrated banking services, businesses can manage their payables effortlessly, making AP automation an invaluable tool in today’s fast-paced business landscape. Embracing this technology is not just an option, but a necessity for businesses to stay competitive, ensure compliance, and promote growth.

Learn more about NetSuite Accounts Payable (AP) Automation.

Serge is a Managing Partner and the head of sales and business development.

Published on: November 23, 2023