Last Modified: January 8th, 2024

3 min read

Accounts receivable automation simplifies and expedites the process of collecting outstanding customer payments.

Before automation, accounts receivable was a manual process with multiple steps and details managed by hand. AR automation technology reduces manual labor and streamlines the process, freeing up employees for higher-value tasks and improving collections efficiency.

By automating AR, you can minimize billing errors, invoice customers promptly, and simplify payment reconciliation. This automation ensures a smoother and more efficient workflow from purchase to payment. Learn more about accounts receivable here.

Invoice Generation, Payments Collection, Reconciliation

Automation simplifies accounts receivable by streamlining invoicing, payment collection, and reconciliation to ensure accurate information. It enables timely invoice generation in a customer-friendly format and reduces data entry for the AR team. Once entered, customer data can seamlessly follow the payment process.

The Advantages of Getting AR Automation

Apart from increasing accuracy, streamlining workflow and facilitating cash flow, these are other things AR automation can do:

Eliminating the need for paper and ink

Paper invoices are prone to errors, can be lost or misfiled, and require dedicated storage. AR automation reduces the need for paper records, making it more sustainable and cost-effective.

Real-time reporting on customer payment statuses

AR automation delivers real-time data that helps businesses keep track of AR aging, sorting customer receivables by outstanding amounts and due dates, and providing visibility into payment statuses. This minimizes the risk of delayed or missed payments.

Fewer problems with billing and payment reconciliation

Invoicing errors can be expensive and time-consuming to correct, and manual reconciliation takes longer than automated processes. Automation ensures that invoices are generated with accurate data and payment processing is error-free.

More manageable compliance with regulations

AR automation helps businesses comply with regulations by providing accurate data and audit trails. It also simplifies the process of providing documentation for audits, saving time and resources.

AR Processes That Can Be Automated

AR automation can be applied to multiple AR processes, including:

Invoice generation and delivery

Automation reduces the time it takes to generate accurate invoices and delivers them directly to customers via email or through an online customer portal.

Payment processing

Online payment portals can automate the process of receiving payments from customers and updating their accounts in real-time. This eliminates the need for manual data entry and reduces the risk of human error.

Payment Reminders

Generate and send emails or text messages to customers one week prior to payment deadlines.

Features to take advantage in AR Automation

AR automation software offers a range of essential features that empower businesses to achieve their goals efficiently and effectively.

Automated emails

Schedule precise triggers that automatically generate emails to customers. For instance, you can notify them a few days prior to a payment due date and follow up, if needed, in case of late payment. Rest assured, this functionality ensures efficient and effective customer communication.

Credit risk and management

Effectively identify customers who are more likely to make late payments or default on their payments. This enables the business to closely monitor customer behavior trends at both the individual and aggregate levels, empowering them with valuable insights to mitigate risks and make informed decisions.

Data reporting

Businesses can efficiently parse customer data based on specific segments or categories, and closely monitor department productivity. This includes analyzing the number of invoices generated and collection calls completed by individual staff members.

Disputes and deductions

Facilitating the deduction of the disputed charge and promptly re-invoicing the customer expedites the resolution of the matter and reduces the wait time for the appropriate payment.

Invoice generation and distribution

Generating and distributing invoices serves as the foundation of AR, and automation software can handle these tasks seamlessly. By invoicing promptly, businesses can expedite payment and enhance their cash flow, ultimately bolstering financial stability.

Multiple points of payment

AR software should provide customers with a wide range of payment options, including check, ACH, credit cards, wire transfer, and peer-to-peer sharing platforms. This demonstrates our commitment to meeting customers’ diverse needs and ensures a seamless payment experience.

Transaction matching

To ensure proper allocation of funds, it is crucial to apply incoming money to the appropriate account. Leveraging AR software tools can streamline this process by accurately matching customer payments with open invoices. As a result, it not only reduces the Days Sales Outstanding (DSO) but also minimizes the manual effort required for cash application.

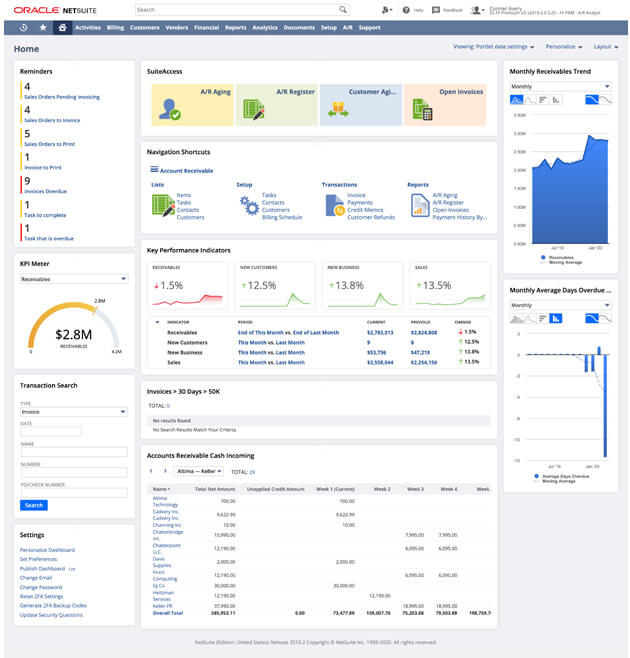

AR Automation in NetSuite does more than just save time

AR Automation enhances the customer experience and reduces human error, all while increasing efficiency and accuracy. With AR automation, businesses can streamline their accounts receivable processes and focus on building relationships with customers rather than administrative tasks. Explore NetSuite’s AR automation capabilities to see how it can benefit your business today.

Learn more about NetSuite Accounts Receivable (AR) Automation.

Serge is a Managing Partner and the head of sales and business development.

Published on: November 21, 2023